The keyword “Market Trend Ftasiafinance” likely represents a financial analysis or market trend report associated with a company, platform, or term named “Ftasiafinance.” Emerging trends in financial markets are pivotal for investment decisions, policy-making, and economic planning. Ftasiafinance, as the term suggests, could focus on Asia-Pacific financial markets, offering insights into sectors like fintech, banking, real estate, or emerging technologies.

The current market landscape in Asia is driven by rapid digitization, increased cross-border investments, and a growing emphasis on sustainability. Key trends include the rise of blockchain in finance, a shift towards renewable energy investments, and the expanding role of artificial intelligence in trading and risk management.

market trend ftasiafinance might analyze these dynamics, providing stakeholders with real-time data, predictive analytics, and strategic foresight. As Asia continues to dominate global growth narratives, tools and platforms centered on its market trends remain indispensable for global investors and businesses.

Overview of Wdroyo Insurance TCNEVS

Wdroyo Insurance could represent a company or service related to insurance offerings, potentially focusing on a specific market or a new insurance technology. Insurance companies often evolve to meet the needs of modern consumers with customized coverage options, including life, health, auto, or property insurance. Digital transformation in the insurance sector, commonly known as “insurtech,” has brought forward innovations like AI-powered claims processing, blockchain for policy management, and personalized insurance packages using big data.

If “Wdroyo Insurance” is a brand, it may focus on these trends, offering services such as:

- AI-Based Policy Pricing: Automating policy pricing using data-driven insights.

- Smart Contracts: Use of blockchain for automated contract enforcement and transparency.

- Telematics in Auto Insurance: Using real-time data from connected devices to calculate premiums.

TCNEVS: Potential Meaning

The term TCNEVS seems to be an acronym or a specific entity. It could stand for:

- Theoretical Claims and Non-Exhaustive Valuation Systems (TCNEVS): A concept or framework in the insurance industry focused on assessing claims and creating financial valuations that are non-exhaustive but cover the most likely outcomes.

- A Technology or Service: “TCNEVS” might also refer to a software tool or platform that streamlines claims management, underwriting, or customer service within the insurance space.

If you meant something specific by “TCNEVS” or “Wdroyo,” let me know, and I can refine the details further!

Key Trends Shaping the Insurance Market

1. Technology Integration

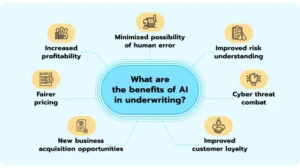

One of the significant trends highlighted by market trend ftasiafinance is the integration of advanced technology in insurance processes. Wdroyo Insurance TCNEVS has been at the forefront of adopting AI-driven underwriting, real-time claims processing, and predictive analytics to improve customer experience and operational efficiency.

2. Sustainability and ESG Initiatives

Environmental, Social, and Governance (ESG) considerations are increasingly influencing insurance providers. Wdroyo Insurance TCNEVS has launched eco-friendly insurance products that reward sustainable practices among policyholders, aligning with global efforts to combat climate change.

3. Personalized Insurance Solutions

Customization is becoming a cornerstone of modern insurance services. By utilizing big data analytics, Wdroyo Insurance TCNEVS offers personalized policies tailored to individual and business needs, ensuring optimal coverage and cost-effectiveness.

4. Expansion in Emerging Markets

market trend ftasiafinance’s reports emphasize the growing potential in emerging markets. Wdroyo Insurance TCNEVS has strategically expanded its operations in Asia, capitalizing on the region’s increasing demand for comprehensive insurance solutions.

Strategies Driving Success

Innovation and R&D Investments

To stay ahead of the curve, Wdroyo Insurance TCNEVS invests heavily in research and development. This commitment ensures they consistently roll out innovative products and services that meet evolving market demands.

Collaborative Partnerships

By collaborating with fintech companies and leveraging insights from platforms like FTAsiaFinance, Wdroyo Insurance TCNEVS enhances its offerings and strengthens its market position.

Customer-Centric Approach

Placing customers at the heart of its operations. The company prioritizes transparency, affordability, and seamless service delivery, fostering long-term loyalty and trust. For more visit my website techplusemag

Conclusion

The partnership between Wdroyo Insurance TCNEVS and market trend ftasiafinance provides valuable insights into the dynamic insurance market. As trends like technology integration, sustainability, and personalization continue to shape the industry. Companies like Wdroyo Insurance TCNEVS are well-positioned to lead the way, setting benchmarks for innovation and customer-centricity.

Staying informed on these developments is crucial for stakeholders aiming to navigate and thrive in this ever-changing landscape.